International Shipping Forms & Information

Customs Forms

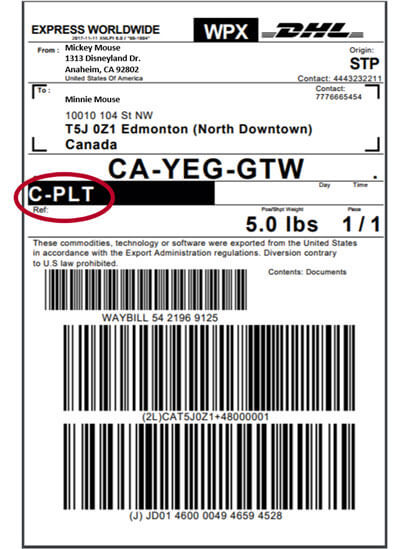

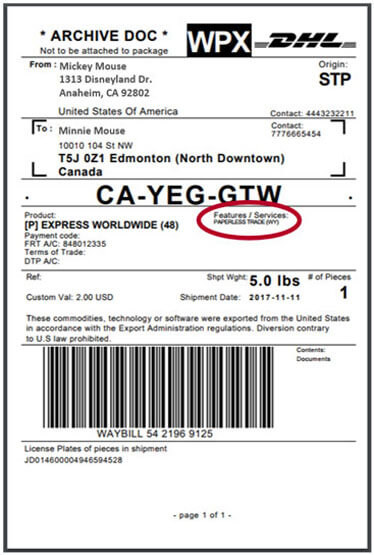

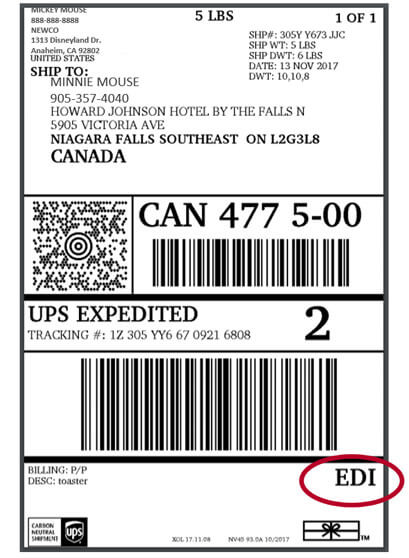

We automatically submit your customs forms electronically for UPS (via Electronic Data Interchange, or EDI), DHL Express (Paperless Trade, or PLT) and FedEx (via Electronic Trade Documents, or ETD) for the companies that are available in the drop-down for international shipping.*

Electronic form submission happens when you create a shipment for any orders that

1) require a customs form, and 2) are being sent via these carriers.

*Be mindful that certain restrictions may apply based on destination. If you do not see the circled codes (identified below for each carrier) displayed on your label you will need to print the forms and send them on your package.

If you see INV instead of EDI then that means the customs information will not be transmitted electronically for your UPS shipment.

Steps To Ship Internationally

- Is the international shipment documents (written, typed or printed communication) or a non-document shipment?

- If documents, only a shipping label is required which should state: ”documents at $0 commercial value”.

- If a non-document, a shipping label, 3 copies of a commercial invoice and a packing list are required. A non-document shipment must have a fair market value. The packing list should match the description and quantity of the goods on the commercial invoice.

- Note: Dependent on the commodity, commercial value, terms of sale, country of origin, and method of customs clearance there may be additional duties, taxes and charges other than shipping costs.

- If shipping to Mexico (> $1,000 US) or Canada (> $2,500 CAD) dependent on the value of the shipment a NAFTA certificate could be required.

- If not greater than the amounts shown above than the commercial invoice to Mexico or Canada should read: "I hereby certify that the good covered by this shipment qualifies as an originating good for purposes of preferential tariff treatment under the NAFTA”.

- Dependent on commodity of the good and the country the goods are exporting to the shipment may require a US Certificate of Origin (CO) document. A list of the countries and commodities can be found at: https://www.ups.com/us/en/shipping/international/us-certificate-origin.page

- When the value of the goods being export exceed $2,500 US an Electronic Export Information (EEI) document needs to be filed. This was formerly known as a Shipper Export Declaration (SED) document.